Structured Products In Focus:

What Are They For?

“Structured products aren’t magic — they’re carefully engineered payoffs built to align with specific investor goals.”

Mehdi Rayane, Financial Products Sales

Traditional portfolio tools – stocks, bonds, mutual funds – have served investors well for decades. But as markets become more volatile, inflation re-emerges and correlations shift unpredictably, for some investors, these tools no longer offer the control or precision they seek.

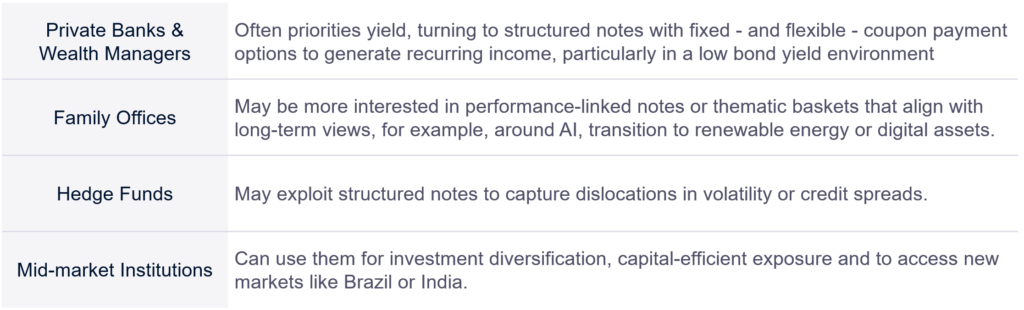

Structured products provide the means to design specific risk/reward outcomes in increasingly uncertain conditions. No longer niche investor products sitting on the shelves of private banks, they have become increasingly important tools in the investment strategies of fund managers, wealth managers, family offices and institutional allocators.

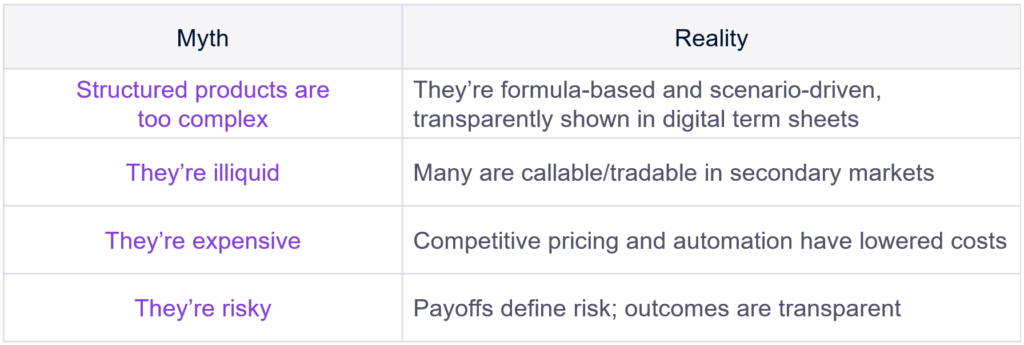

Yet many misconceptions remain about what they are and how they can be used. Are they too complex? Too risky? Illiquid? Or simply misunderstood?

Structured products – back to basics

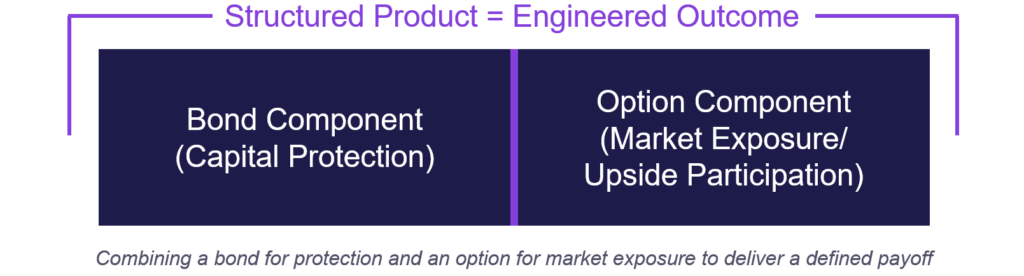

A structured product is a pre-packaged investment that combines one or more financial instruments – typically a bond and a derivative – to create a specific risk-return payoff. Rather than investing directly in the underlying asset (equities, commodities, FX and now crypto), structured products allow investors to gain conditional exposure based on defined market scenarios.

Engineered by design, structured products are configurable instruments built to target:

- Defined outcomes

- Targeted yield

- Thematic access

- Risk buffers

- Tax / regulatory objectives

At their core, they are products engineered to deliver a defined payoff under specified conditions: They can be short-dated or long-term, they can deliver income and/or yield, they can be linked to the performance of any underlying asset or investment type with performance trigger levels.

It is precisely the ability to engineer specific outcomes that is driving the growing popularity of structured products. Unlike buying assets outright, investors define what they want to achieve from the product – be it income, protection, leverage, portfolio diversification or anything else.

“Structured notes are fantastic instruments to express a market view. They can be bullish, bearish, or even range-bound. The point is not to gamble, but to shape risk around your convictions.”

Franck Fayard, Head of Financial Products, APAC

“Fixed income investors already hold bonds. Structured notes feel familiar — but with added flexibility. They can choose the coupon, maturity, and frequency of payments, all while tailoring risk to their needs.”

Mehdi Rayane, Financial Products Sales

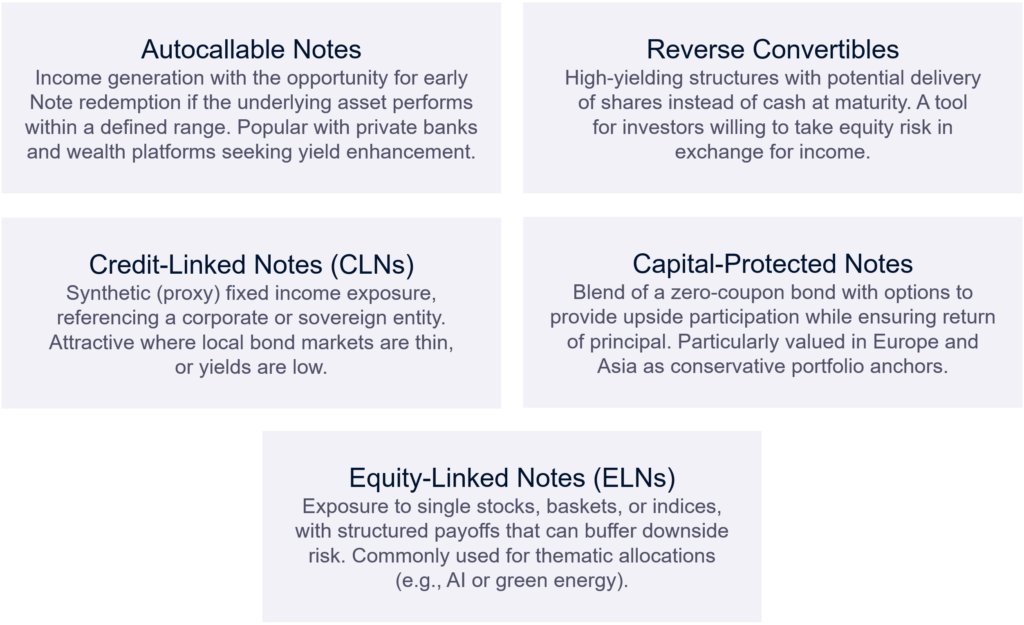

Structured products solve practical investment challenges, recognising that markets can be inefficient and unpredictable, and that investor needs are complex. For example, they can offer buffered downside with defined upside in volatile equity markets, or thematic exposure to ESG, AI or crypto assets, for example, with embedded protections, enabling investors to take a view (dip their toe in the water of new opportunities) without direct investment in the underlying assets.

Similarly, they can meet portfolio diversification objectives within a regulated investment wrapper that satisfies a fund’s ‘rules’ (governing documents) relating to exposure to FX, commodities and alternative investments (e.g. real estate) .

With a modular methodology for engineering specific market exposures, structured products essentially provide the ‘middleware’ for sophisticated portfolio management; the connecting layer linking raw market exposures (e.g. equities, rates, commodities, crypto) to the tailored objectives of investors (income, protection, diversification and thematic exposure).

“Volatility and interest rates shape demand across every market I cover — they’re not obstacles; they’re the raw materials we use to design performance.”

Nestor Macias, Head of Financial Products, LATAM

Common Types of Structured Products

“Education is the real growth lever. Once advisors see structured products as transparent, formula-based tools, adoption accelerates.”

Romain Joubert, Head of Financial Products Sales, France

Debunking misconceptions

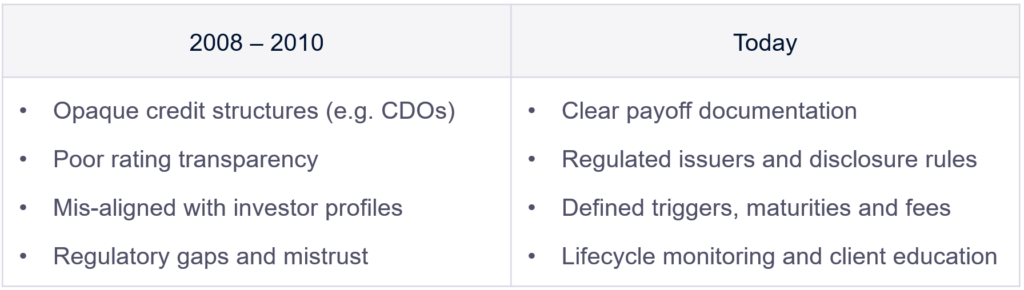

Despite widespread and growing interest in structured products, historical misconceptions about their cost, role and value — particularly around complexity and liquidity — remain. In the past, some of these views weren’t entirely unfounded: opaque pricing, limited transparency, and manual structuring processes often made products appear costly or difficult to compare.

Today, however, growing competition and technology-enabled price quoting have transformed that perception. Structured notes are now far more cost-transparent and cost-effective. Digital pricing engines and client-facing platforms showing live spreads, implied volatility and scenario-based returns enable investors to compare pricing across multiple issuers with ease.

It’s complicated…

While the bespoke nature of a structured product – the fact that it is precisely engineered to reflect a specific market view and/or desired outcome – makes it appear to be more complex than a plain vanilla investment, in reality, the majority of structures follow clear formulas.

“Products are formula-based. Scenarios are transparent from the outset. There’s no mystery – it’s just about how well these are communicated.”

Franck Fayard, Head of Financial Products, APAC

Today, structured products are delivered with visual payoff diagrams, digital term sheets and real-time pricing platforms. Further, many structures are callable or tradable in secondary markets, especially when issued off regulated platforms; issuers typically endeavour to provide daily secondary pricing and additionally, some degree of restructuring flexibility in stressful market conditions.

“We proactively restructure underperforming notes – extending maturities to give clients time to recover in volatile periods.”

Franck Fayard, Head of Financial Products, APAC

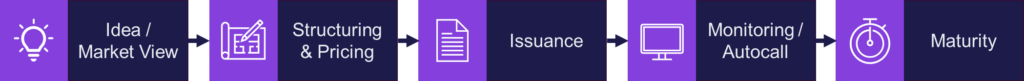

Today’s successful structured product issuers invest continually in tools that visualise payoffs, automate lifecycle monitoring and simplify client reporting. Alongside education and communication, this replaces complexity with clarity, making structured notes attractive and accessible to every professional investor segment.

Too risky?

High yields reflect pricing of market volatility, not hidden traps. Investors simply need to decide whether the risk/reward trade-off suits their specific market view or desired outcome. The core feature of structured products is that risk/reward profiles can be defined – if not the performance itself. Risk is, therefore, an integral component of any structured product specification and engineering process.

“We see structured products simply as building blocks – whether underpinned by equity, interest rates, options et al – that have been engineered to fit an investor’s specific needs.”

Martin Kummer – Investment Solutions

In terms of broader market sentiment relating to the overall ‘riskiness’ of structured products, they have come under a certain amount of fire for their contribution to previous financial crises (and more recent major bank failures). Historically, certain types of products, for example the CDOs (Collateralized Debt Obligations) that played a central role in the 2008 global financial crisis, were opaque in design and mis-rated by credit agencies, resulting in panic and chaos when housing markets collapsed and the value of the underlying mortgages plunged, resulting in systemic financial meltdown.

However, we’ve come a very long way since 2008 both in terms of market regulation and mandatory obligations relating to transparency and accountability and investor education around the ‘right way’ to implement structured products within investment strategies.

Today, investors are absolutely clear about the risk profile of any structured product in advance – trigger levels, maturities, costs/fees and payoff scenarios.

“Clients want to know what they will end up with at the end of the life of the structured product. And it is defined; there’s no mystery, no surprises.”

Nestor Macias, Head of Financial Products, LATAM

Education, education, education

Traditional assets are blunt instruments. A stock will either rise or fall. A bond will either pay out or default. Structured products introduce nuance with respect to risk vs. return, conditional vs. fixed income and exposure to hard-to-reach themes.

Education is the key to changing perceptions across investor segments.

“Some Investors may see structured products as a black box. The solution is transparency: show the building blocks, show the lifecycle, and the mystery disappears.”

Mehdi Rayane, Financial Products Sales

Investment with intention, precision not prediction

Global financial markets are no longer powered by simple narratives. Traditional investor paradigms – long equity, short duration, diversification through passive allocation – appear to be becoming increasingly unreliable, particularly in today’s uncertain geopolitical and macroeconomic times.

In a world of macro fragmentation, thematic dispersion, and tightening regulatory constraints, structured products help define the ‘how’ behind the ‘why’ of investing.

“Clients are curious about new exposures like digital assets, but they want to access them responsibly — through structure, not speculation.”

Joost Burgerhout, Head of Marex Financial Products

For asset managers, wealth platforms and institutional allocators, the challenge is how to deliver performance and growth in a controlled way: Control over outcomes, over exposures and in the way risk is expressed. Structured products are powerful tools for building control. Not because they offer certainty, but because they offer specificity. Structured products are about investment with intention, precision not prediction – not chasing fads or replacing traditional asset allocation strategies. In any portfolio bonds may under-yield, equities over-expose and alternatives under-deliver. Structured products are neither a niche nor speculative asset class, but a highly efficient delivery mechanism for precise investment exposure, in a modern wrapper.

They don’t replace traditional tools. They refine them, to deliver designed, tested and defined (expected) outcomes. In a world where every basis point and unit of risk counts, structured products aren’t exotic add-ons, they’re essential tools for modern portfolio management.