In late 2024, clients began inquiring about how to gain exposure to the nuclear energy trade — a theme increasingly linked to the rise of artificial intelligence. In response, we launched structured products linked to a uranium index, offering risk-managed access to this bullish narrative. Since then, the uranium equity market has rallied sharply, even as the spot commodity price has consolidated.

Market Commentary

Uranium prices peaked in early 2024 above $100/lb and have since moderated to around $80–$83. But uranium equities have been a standout in 2025. Why?

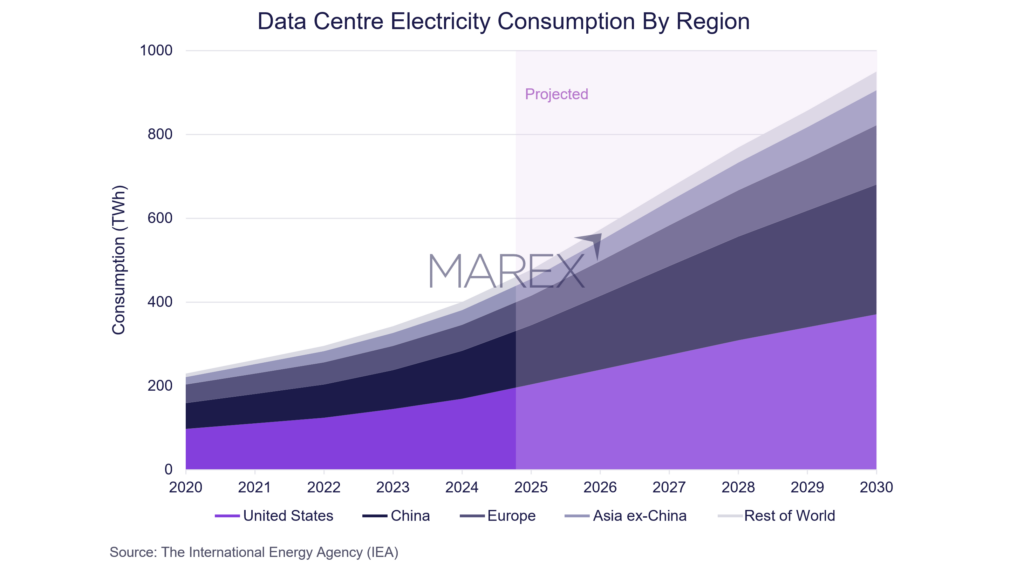

AI is Driving New Energy Priorities: The energy demands of AI infrastructure are rising fast. Hyperscale data centres require reliable baseload power, prompting tech firms to explore nuclear as part of long-term procurement plans. From Microsoft’s nuclear team hires to policy support for SMRs, nuclear is being reconsidered through a digital lens. That shift has helped reframe the role of uranium in the energy stack.

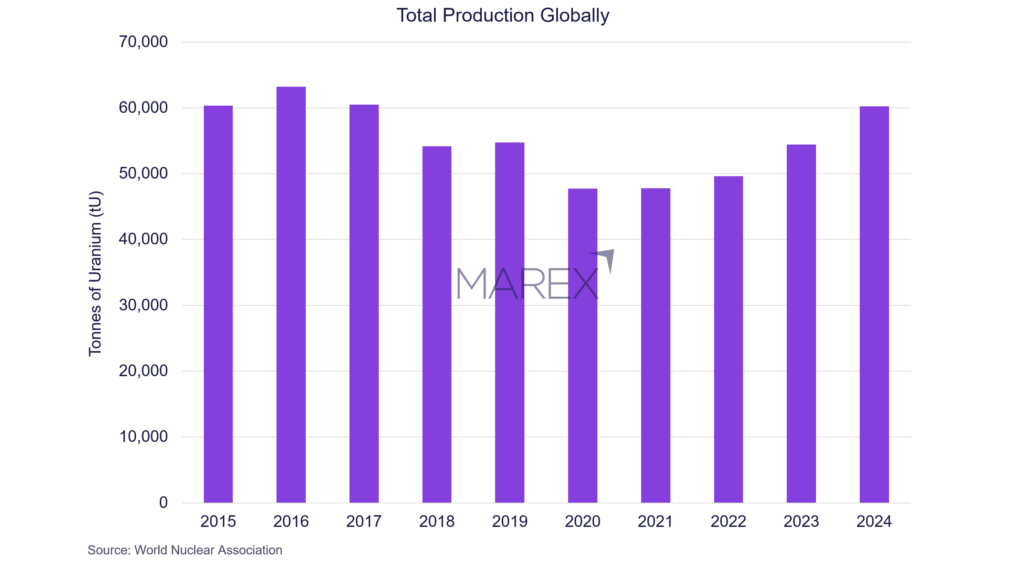

Supply Lagging Behind: Uranium production remains structurally constrained. Cameco lowered 2025 output guidance after delays at McArthur River; Kazatomprom is cutting production by 10% in 2026. Utilities are returning to long-term contracting, but available supply is limited. It’s not just about digging up more ore — permitting, financing, and enrichment bottlenecks are all in play.

Financial Demand Adds Fuel: Physical uranium investment vehicles (e.g. Sprott Physical Uranium Trust, Yellow Cake plc) continue to absorb supply. In Q3 alone, over 2.3 million pounds were removed from the market. Meanwhile, uranium ETFs have seen renewed inflows, and equity indices tracking uranium miners are up more than 50% YTD.

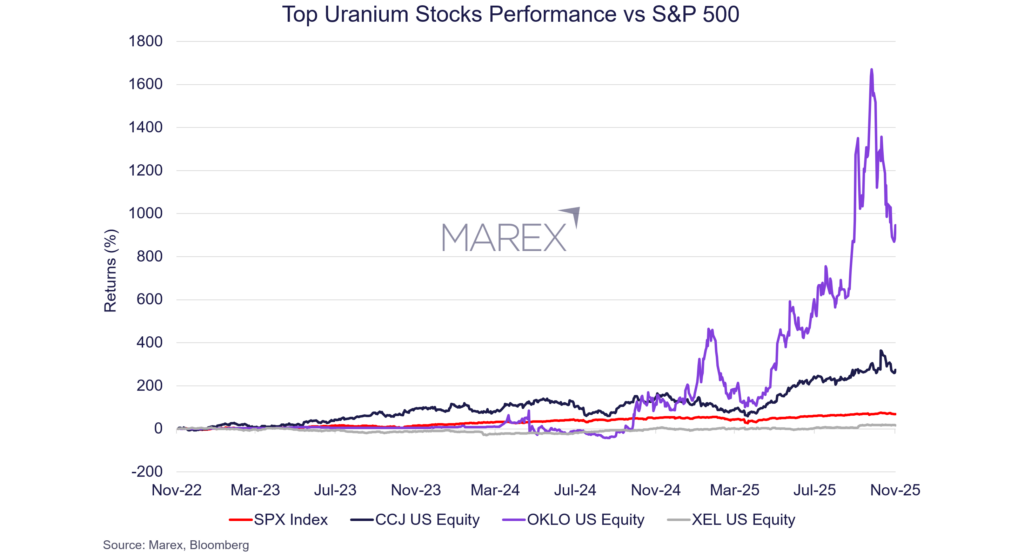

On the equity front, as of writing, OKLO is up 306%, CCJ 70%, and XEL 22% YTD — all outperforming the S&P 500’s 16% gain. These include Cameco (CCJ), one of the world’s largest uranium suppliers; Oklo (OKLO), a recently listed developer of advanced small modular reactors; and Xcel Energy (XEL), a diversified U.S. utility with nuclear generation in its portfolio.

How Clients Are Engaging with Uranium

One way to gain exposure to uranium is through structured strategies that replicate the performance of uranium-linked assets while incorporating risk controls. In our Investment Opportunities 2025 publication, we featured one such example.

Interested in Uranium Exposure?