Ethereum has staged a sharp rally in 2025, drawing renewed attention from investors seeking ways to participate in its growth. In response, we offered clients various digital asset–linked solutions, including an ETH-linked product designed to balance upside participation with capital protection.

Source: Bloomberg

Source: Bloomberg

Market Commentary

Ethereum has been one of the standout performers of 2025, driven by several factors:

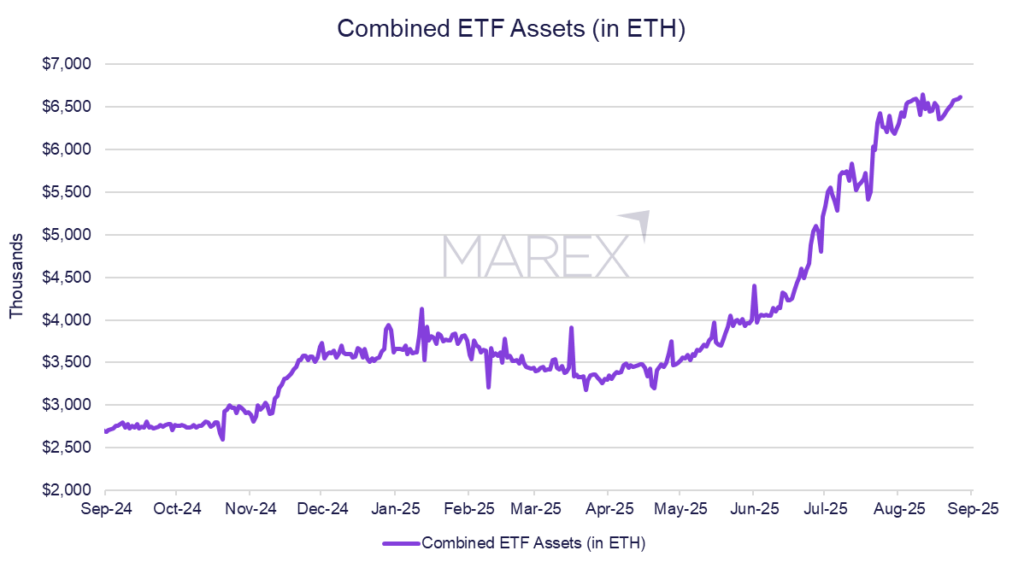

- Institutional Demand & ETFs: Inflows to spot ETH ETFs have picked up dramatically this year, often outpacing inflows to BTC ETFs, creating a more liquid, regulated access point for investors.

Source: Bloomberg

Source: Bloomberg

- On-Chain Activity & Stablecoins: Ethereum remains the backbone of DeFi and the stablecoin ecosystem (e.g. USDT, USDC). Stablecoin settlement volumes are rising, supported by lower transaction costs following recent upgrades. Importantly, major banks are now piloting stablecoin payments for cross-border and real-time settlement, reinforcing the chain’s role as core financial infrastructure.

- Supply Dynamics: A larger share of ETH is staked or locked in DeFi protocols, while the ongoing burn mechanism reduces circulating supply. Together, these dynamics tighten the available float and underpin price resilience.

- Macro Tailwinds: Softer USD, expectations of Fed rate cuts, and improving regulatory clarity are boosting sentiment across the crypto complex.

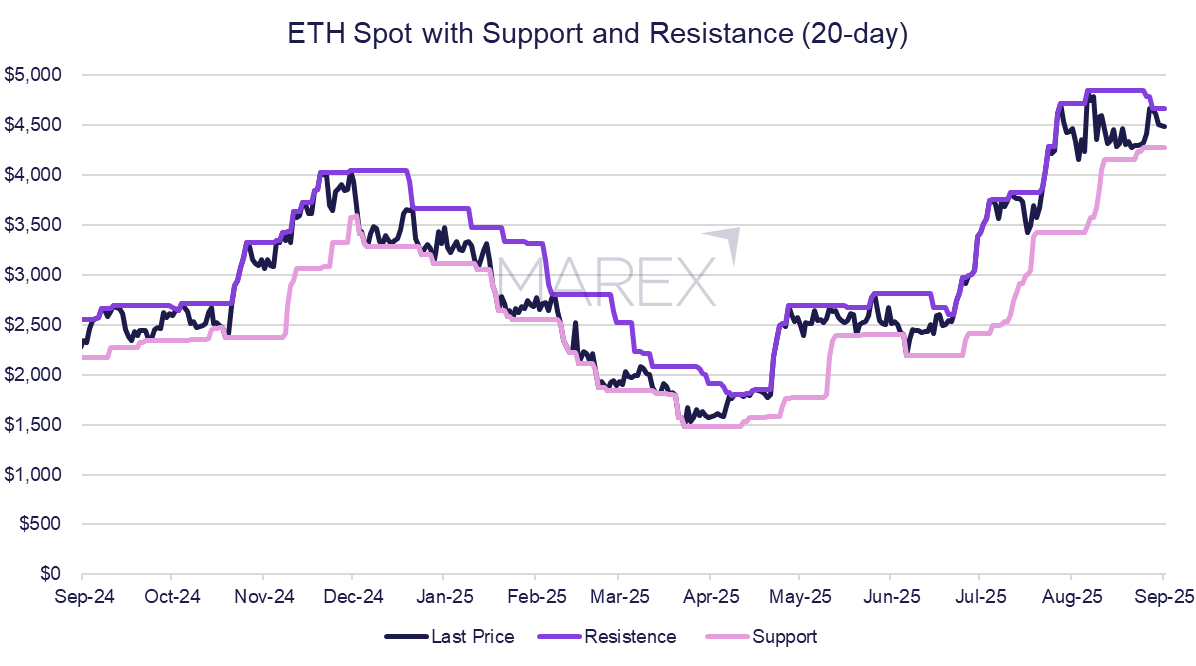

- Technical Momentum: ETH recently posted its highest weekly close in four years and is testing resistance closer to $4,000, with bullish momentum supporting continued client interest.

Source: Bloomberg, Marex

Source: Bloomberg, Marex

How Clients Are Engaging with Ethereum

Institutional investors have increasingly asked for ways to balance risk management with upside exposure when allocating to digital assets. Within our Investment Opportunities 2025 publication, we discussed the broader concept of using structured products that combine capital preservation features with participation in market growth.

Ethereum has been a focal point for many clients, reflecting both its strong performance and its growing role in institutional portfolios. Our work in this space focuses on designing solutions that can provide structured, risk-managed exposure – always tailored to the objectives and constraints of professional investors.

If you are interested in understanding more about the types of approaches available for digital asset exposure, our team would be pleased to discuss this with you.

*All requests will be reviewed internally before granting access to the 2025 Investment Opportunities e-booklet. Please note, this is for professional/institutional investors only and may not be shared

This article has been prepared by Marex for information purposes only.

Information in this article should not be considered as advice, or as a recommendation or solicitation to purchase or otherwise deal in securities, investments or any other products. The article does not take into account particular investment objectives, risk appetites, financial situations or needs. Recipients of the article should make their own trading or investment decisions based upon their own financial objectives and financial resources.

This article may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to Marex’s businesses and operations, market conditions, results of operation and financial condition, capital adequacy, specific provisions and risk management practices. Readers are cautioned not to place undue reliance on these forward-looking statements which may be subject to change without notice. While reasonable care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Marex’s control. Past performance is not a reliable indication of future performance.

The information contained herein is current as at the date of publication. No part of this article may be redistributed, copied or reproduced without prior written consent of Marex. While reasonable care has been taken to ensure that the facts stated are fair, clear and not misleading, Marex does not warrant or represent (expressly or impliedly) their accuracy or completeness. Any opinions expressed may be subject to change without notice. Marex accepts no liability whatsoever for any direct, indirect or consequential loss or damage arising out of the use of all or any of the data or information in this article.

This article was approved by Marex Financial (“MF”). MF is incorporated under the laws of England and Wales (company no. 5613061, LEI no. 5493003EETVWYSIJ5A20 and VAT registration no. GB 872 8106 13) and is authorised and regulated by the Financial Conduct Authority (FCA registration number 442767). MF’s registered address is at 155 Bishopsgate, London, EC2M 3TQ.

The Marex® group of companies includes Marex Financial (including the Marex Solutions division), Marex Spectron International Limited, CSC Commodities UK Limited, Tangent Trading Limited, Marex Spectron Europe Limited, Marex North America LLC, Marex Capital Markets Inc, Marex Spectron USA LLC, Spectron Energy Inc., Marex Australia Pty Ltd, Marex MENA Limited, Marex Hong Kong Limited, Marex Spectron Asia Pte. Ltd., Spectron Energy (Asia) Pte. Ltd., Marex France SAS (including the BIP AM division), X-Change Financial Access, LLC, Starsupply Petroleum Europe B.V., Volcap Trading Partners Limited, Volcap Trading Partners France SAS and Arfinco S.A (individually and collectively “Marex”).

© 2025 Marex. All rights reserved.