Structured Products In Focus:

Institutional adoption and applications

“Structured products are increasingly considered as strategic investment tools, not just wrappers.”

Walter Cegarra, Head of Institutional Solutions

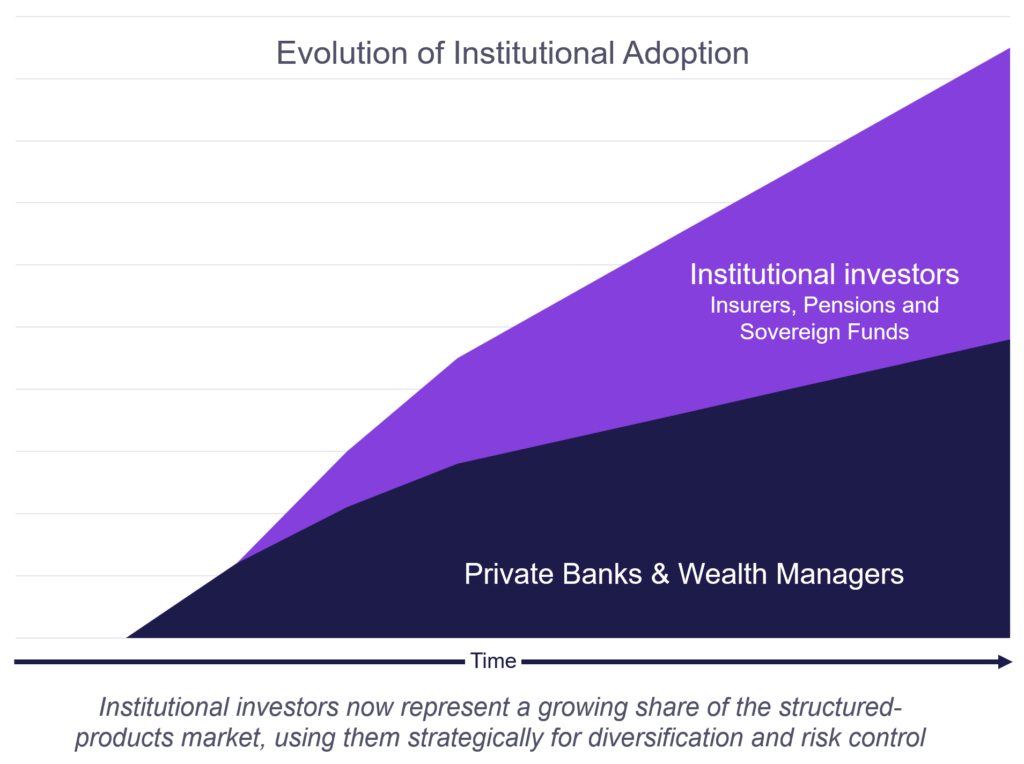

While structured products may be most commonly associated with private banks and wealth platforms, institutional investors – insurers, pensions, sovereign wealth, asset managers, hedge funds and other own account investors -are looking increasingly at the opportunities presented by these instruments.

The rationale for structured products is clear: yield enhancement within defined risk parameters, overlays to manage risk exposures and capital-efficient portfolio diversification. Institutional investors are turning to structured products not only for yield, but also for diversification into harder-to-reach exposures, for example, new crypto and digital assets, commodity baskets, real world (e.g. real estate) and even private assets, but in a risk-controlled format.

“Institutions are not just chasing yield; they want diversification into exposures that are otherwise difficult to access like digital assets and private markets. Structured products provide a risk-controlled pathway while staying firmly within the rigorous compliance and reporting frameworks of institutional investment.”

Walter Cegarra, Head of Institutional Solutions

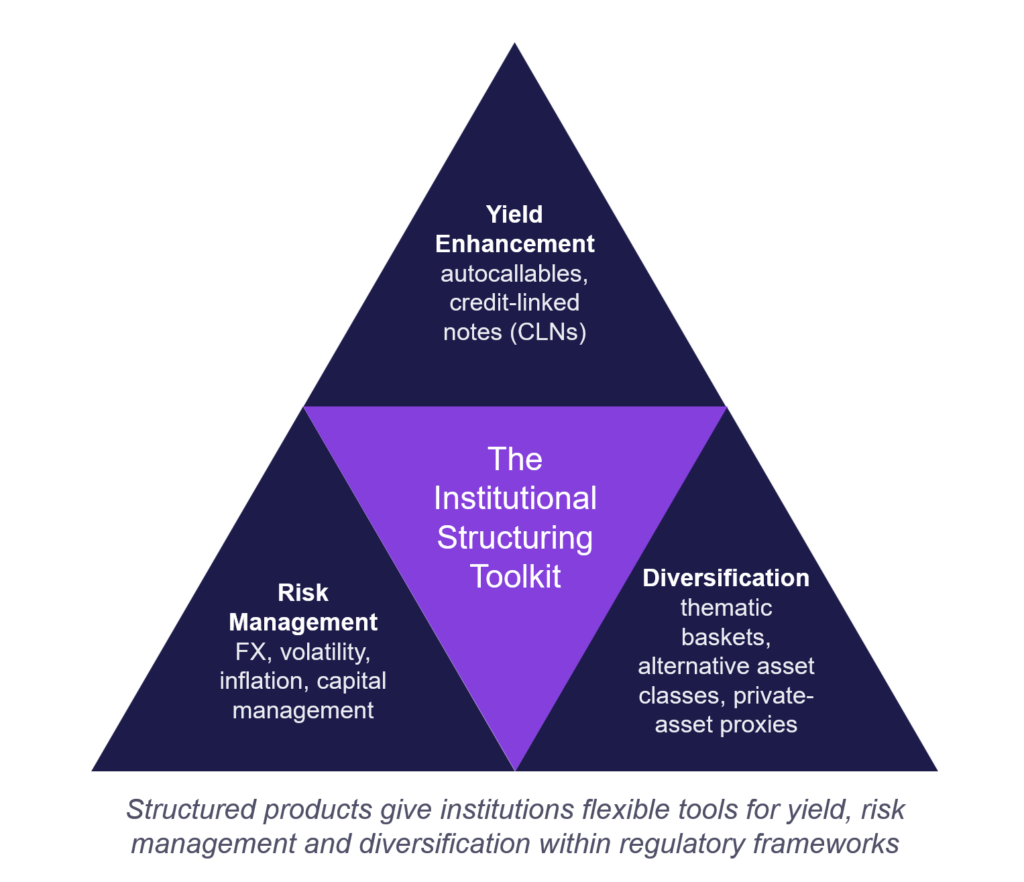

The institutional structuring toolkit

Institutions operate under constraints that differ from wealth managers. Capital adequacy mandates and obligations, associated impacts on working capital, strict liquidity requirements, and risk-weighted portfolio considerations all shape institutions’ allocation decisions.

Structured products can offer any combination of:

- Yield enhancement within predefined risk budgets (e.g. callable credit-linked notes)

- Overlay strategies to manage FX, volatility, inflation or capital exposures

- Thematic allocations packaged to meet internal governance standards

“Market forces apply to all structured product types, whether yield, diversification or market access. The imperative for institutions is to ensure alignment with regulation and risk frameworks.”

Walter Cegarra, Head of Institutional Solutions

Yield within risk budgets

In a climate of unpredictable bond yields and compressed credit spreads, insurers and pensions use structured notes to design income streams that meet actuarial targets, without compromising mandated solvency ratios or LDI (Liability-Driven Investment) capital obligations.

“For regional pension funds, structured credit fits naturally within an LDI framework — it delivers the kind of predictability those strategies are built around.”

Nestor Macias, Head of Financial Products LATAM

With respect to LDIs in particular, credit-linked notes (CLNs) referencing sovereign debt or investment-grade corporate debt can be a very effective means of generating enhanced coupons, while remaining within defined credit buckets.

“When rates dropped to zero, CLNs became a bond alternative. Institutions needed income, and structured products gave them defined exposure with extra yield.”

Martin Kummer, Investment Solutions

Risk management overlays

Institutions often use structured notes as a risk management overlay that doesn’t disrupt underlying portfolios. Institutional clients are also using structured products increasingly as a way to access markets and exposures that would otherwise be operationally complex or restricted.

By wrapping emerging market equities – for example, in Brazil or India – into certificates, or structuring trades around niche commodities like cobalt or platinum, institutions can achieve tailored exposure in a format that aligns with governance requirements and internal risk frameworks.

This makes structured products especially attractive for insurers subject to Solvency II, and for pension funds managing liability-driven investment strategies. By packaging credit or rate exposure into defined-outcome notes, institutions can build actuarially-consistent income streams without incurring punitive capital charges.

“Institutions want precision. A structured note can mimic a bond, hedge an FX position, or deliver exposure to digital assets – all in a regulated wrapper.”

Walter Cegarra, Head of Institutional Solutions

Example use cases:

- FX: Hedging USD exposure in Latin America through FX-linked notes

- Volatility: Using autocallables to monetise high implied vol while protecting downside

- Inflation: Notes linked to inflation indices to offset liability risk

Collaboration, not competition

Institutions rarely rely on a single structurer relationship, more typically they work with a mix of bank and non-bank issuers. Marex often partners with issuer banks to provide speed and flexibility in product creation and distribution, or to create specialised structured products with particularly niche or unusual underlyings. This “coopetition” model allows institutions to balance credit quality with the most innovative product structures.

“Large institutions may prefer bank issuers for credit. But they come to Marex for what the banks can’t offer – speed, creativity and unmatched customisability, for example, commodity-linked wrappers.”

“Large institutions may prefer bank issuers for credit. But they come to Marex for what the banks can’t offer – speed, creativity and unmatched customisability, for example, commodity-linked wrappers.”

Martin Kummer, Investment Solutions

Regulatory capital and liquidity windows

Institutional mandates are also shaped by capital adequacy rules: banks are subject to ever evolving Basel obligations (currently Basel III), insurers are regulated in Europe under Solvency II; pensions must manage liability-driven investment (LDI) strategies. Structured solutions are effective tools in and across all of these regulatory-heavy scenarios, facilitating the efficient transfer or risk (e.g. credit-linked notes) or providing capital-efficient, off-balance sheet overlay structures.

Insurance companies in particular are becoming more active in this space,using structured products as asset/liability management tools and also as the basis for policyholder portfolio solutions. And because these notes can be issued in securitised and listed formats, they also create new liquidity windows that fit with regulatory requirements.

“Notes are only as liquid as their underlyings. For institutions, daily secondary pricing and restructuring options make them attractive and viable portfolio tools.”

Franck Fayard, Head of Financial Products APAC

Transactional to strategic

Institutions once viewed structured products as tactical, one-off or limited investment opportunities to capture additional yield. More and more, however, they are acknowledged as highly valuable, strategic building blocks in effective portfolio management. Institutional demand can shift rapidly in response to macro events – central bank policy changes, tariff shocks or inflation surprises can trigger immediate reallocations. In this environment, structured notes are particularly useful, precisely because they can be structured and launched quickly, giving allocators a highly flexible toolkit to react to fast-changing conditions.