Structured Products In Focus:

New thematic frontiers: crypto, digital and ESG

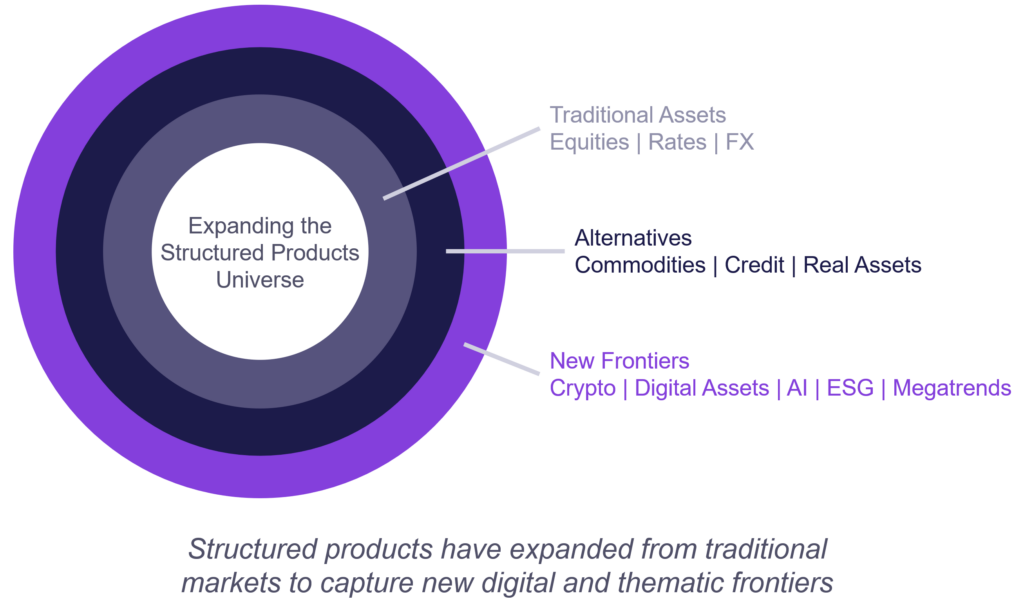

Structured products are no longer confined to the traditional asset classes of equities, rates and currencies. The past ten years or so have heralded the introduction of trends such as crypto and other digital assets, the artificial intelligence megatrend, as well as sustainability themes. Regardless of differences in geopolitical views and regulatory approaches, these themes are having a growing influence on investor mandates and allocations.

As investors seek access to digital assets, sustainability themes, megatrends and other event-driven thematics, it falls on product structurers to engineer intelligent solutions to provide exposure with boundaries; participation with defined risk.

“Clients want next-gen exposure — but on their terms”

Joost Burgerhout, Head of Marex Financial Products

Historically, structured notes were associated with large-cap equities and major indices, seeking primarily to enhance returns from traditional investments by linking them with another product, for example principal protection with guaranteed income.

Today’s far more market-savvy clients want to explore the potential presented by crypto, for example, but in a controlled, risk-defined environment. The appeal of these structured products linked to digital assets and thematics is not simply speculative upside, it is controlled access with boundaries.

What’s new in structured products?

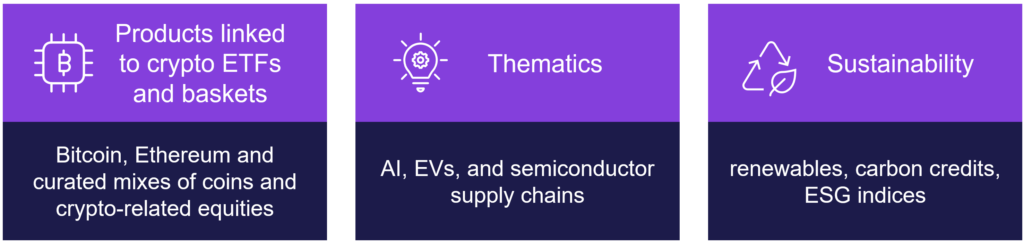

“We were among the first to launch structured notes linked to Bitcoin ETFs. Demand was immediate, because investors wanted defined coupons and protection, not just raw crypto exposure.”

Franck Fayard, Head of Financial Products, APAC

Curation is key

“We’re building bridges between traditional finance and digital markets. Structure is what makes those bridges to cross.”

Joost Burgerhout, Head of Marex Financial Products

Access is not enough – investors want curated solutions with customised outcomes. Family offices and wealth managers, for example, are increasingly seeking structured notes on baskets designed around specific narratives and events, from AI market leaders and clean energy supply chains to crypto-adjacent equities. These curated baskets allow investors to express a conviction without relying on single-asset volatility.

“We worked with a family office on a cobalt trade. By wrapping the exposure in a structured format, we turned a commodity bet into a yield-enhancing, capital-efficient instrument.”

Martin Kummer, Investment Solutions

Managing volatility through structured wraps

Digital assets and thematics can be extremely volatile. Structured notes allow investors to harness volatility while limiting downside risk. For example, capital-protected notes may use a combination of bonds and options to ensure principal repayment with upside exposure.

Fixed coupon notes (FCNs) offer high yield on volatile assets, subject to prices remaining within defined barriers. (It’s easy to see the attraction – some crypto-linked FCNs have delivered coupons above 20% p.a.). Autocallables on thematic baskets generate assured income and at the same time give issuers the option to redeem early if performance stabilises.

“Structured notes let investors add protection layers to reduce the volatility of a crypto bucket, rather than taking outright Delta-1 risk.”

Franck Fayard, Head of Financial Products, APAC

Innovation committees and co-creators

Many allocators co-design structured products with solution providers. Advisory committees within family offices, pensions and sovereign funds often collaborate with structurers to define themes, select underlyings and set barriers. In some regions, banks and investors raise specific structural, regulatory or portfolio constraints that need to be reflected in product design. Co-creation ensures that any products created are aligned with investor and regulatory demands.

This collaborative process — a complete volte-face from the legacy ‘if you build it, they will come’ approach favoured by old-school issuers — is shaping tomorrow’s structured-product frontiers while at the same time ensuring that innovation is firmly grounded in investor, not issuer, priorities.

Thematic investing with discipline and control

Thematic opportunities like crypto, ESG, and megatrends like AI are here to stay. Professional allocators demand discipline, transparency and risk control and structured products provide exactly that – the ability to invest efficiently in tomorrow’s themes, without abandoning today’s control and prudence.