Structured Products In Focus:

Beyond the 60/40: What purpose do they serve in modern allocation models?

“We’re not just managing risk. We’re designing it.”

Nestor Macias, Head of Financial Products, LATAM

The traditional 60/40 portfolio has been a cornerstone of asset allocation for decades: 60% equities for growth, 40% bonds for stability. But in today’s environment of interest rate volatility, inflation shocks and geopolitical uncertainty, this once-reliable formula is increasingly fragile.

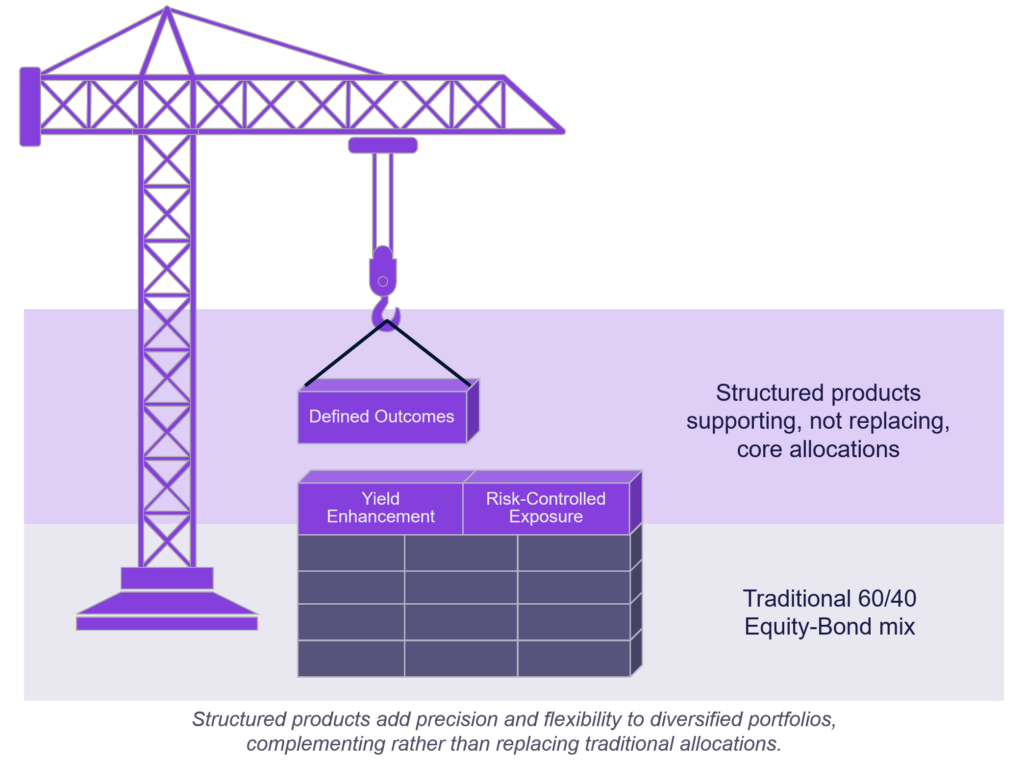

Structured products are stepping into this gap. By engineering outcomes across yield, protection and thematic exposure, they allow allocators to move beyond blunt diversification and into precision portfolio design.

A new investment frontier?

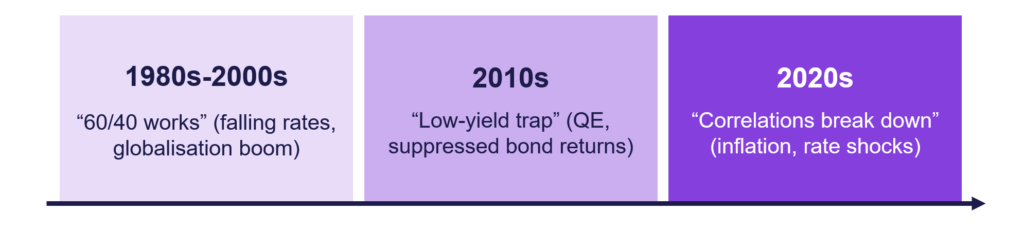

For much of the post-1980s era, lower interest rates supported bond markets while globalisation boosted equities. But the last decade has shifted that paradigm with inflation eroding bond yields, and sharp interest rate rises compressing fixed income valuations. At the same time, the globalisation trend has begun to reverse.

Following the 2008 global financial crisis, monetary policy regimes shifted. Central banks cut interest rates to near-zero and introduced quantitative easing (QE) to support bond markets, keeping prices high and yields low – a safe haven for increasing government debt. Equity markets had a more rocky recuperation: Corporate profits recovered eventually, particularly in the US, but the rampant globalisation that pre-empted the crash was beginning to plateau. In these circumstances, growth was becoming increasingly dependent on cheap credit and continuing monetary stimulus.

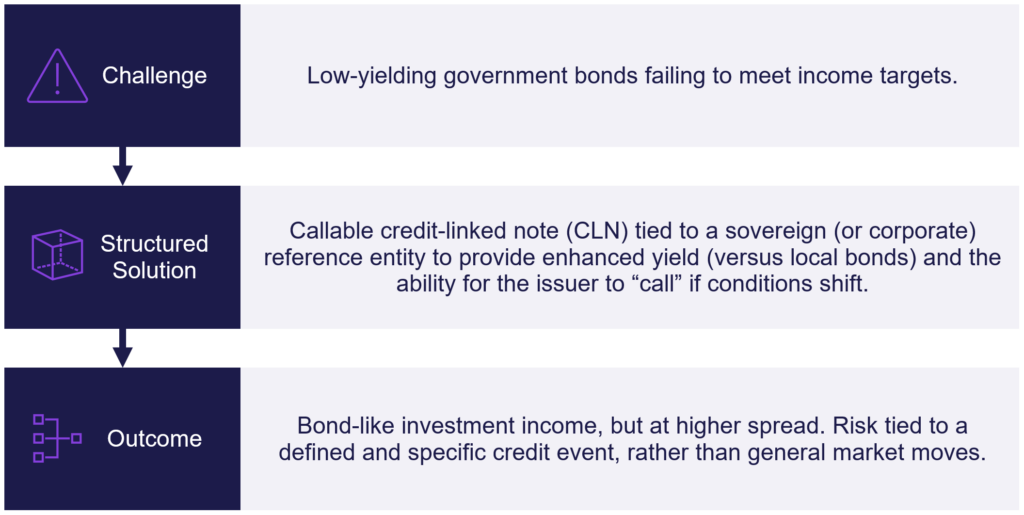

“In Europe, rates dropped from 4% to near zero. Bonds no longer gave a yield. Investors came to us asking how to generate income without simply piling into equities.”

Martin Kummer, Investment Solutions

This ‘low for longer’ mindset prevailed throughout the 2010s, with rates pinned down and returns increasingly constrained in what was an already low-yield environment. The key driver of equity performance started to shift from globalisation to absolute financial conditions while tech and growth stocks benefited from cheap borrowing and abundant liquidity. Buybacks, underpinned by low-cost debt, became a major support to stock prices.

Nonetheless, the 60/40 diversification model still worked, and bonds continued to rally when equities wobbled.

This all changed in 2021-22, following the global pandemic and associated and necessary stimulus measures, the return of inflation, supply chain bottlenecks and energy price shocks e.g. triggered by the Ukraine/Russia conflict.

Taking their lead from the US Federal Reserve, central banks around the world hiked interest rates steeply, breaking the bond bull market and causing government and corporate bonds to suffer enormous drawdowns. In turn, rising rates compressed equity valuations, particularly in growth and tech stocks.

In perhaps the most seismic shift, globalisation momentum first stalled, then began to reverse, driven by geopolitical tensions – most notably US and China’s “conscious uncoupling” – and other ‘reshoring’ and supply chain de-globalisation policies, ostensibly in the guise of “resilience” but evidently supporting more protectionist economic (and political) strategies.

So, to the present: Investors today exist in a regime in which higher yields correlate to more volatile markets and bonds no longer have guaranteed ‘protections’. Traditional safe havens like Treasuries and gold have become less predictable. Equities continue to face structural headwinds on the back of the higher cost of capital, anticipated downturn and increasing cross-market equity price correlation. Added to the mix, inflation uncertainty is creating correlation risks between these core asset classes.

Consequently, investors are having to rethink portfolio allocations and to restore and enhance diversification like commodities, real world assets like real estate, private markets and hedge funds. While all of these alternative investment opportunities can be accessed directly, structured investment products offer a much more efficient and effective solution to performance protection and enhancement.

“Structured notes let allocators express modern themes like tokenisation or AI without abandoning their risk budgets.”

Joost Burgerhout, Head of Marex Financial Products

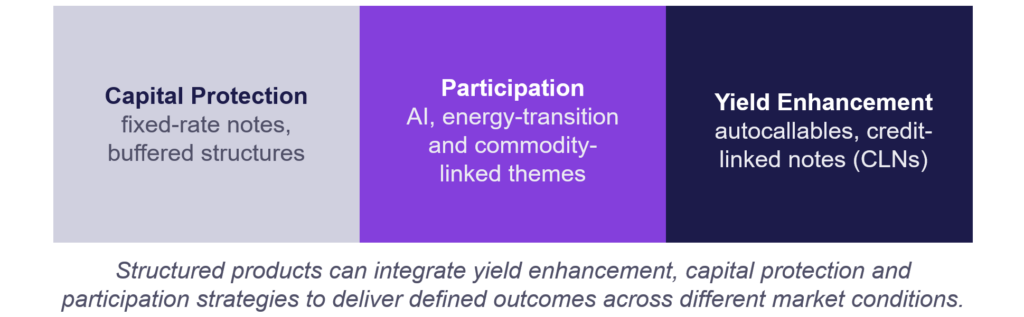

Structured solutions can be engineered to replicate bond-like income or equity-like absolute return, but with tailored risk conditions and explicit buffers. They provide investors with levers and opportunities that are simply not available within a traditional 60/40 model.

“Investors ask not just about returns, but about the endgame – “what will I have at maturity?” Structured notes with defined outcomes can answer that question.”

Nestor Macias, Head of Financial Products, LATAM

- Conditional yield: Engineered auto-callable structures enable investors to accept contingent or conditional payouts in exchange for higher returns.

- Capital protection: Products like fixed rate notes (FRNs) can guarantee principal while still offering 100–200 basis points above risk-free rates.

- Diversified payoffs: Notes linked to currency and commodity indices offer efficient access to uncorrelated returns.

Risk parity to payoff

Risk parity strategies that balance allocations across asset classes by volatility have been a popular evolution of the traditional 60/40 model but in reality, these rely heavily on bonds as ‘diversifiers’. Structured products can achieve the same objectives – and go even further – embedding volatility and interest rate dynamics directly within the payoff rather than as an overlay. This shift reframes the diversification model, using engineered instruments to define specific exposure(s) rather than relying on imperfect correlation.

“Volatility is not just a risk to be hedged. It’s a building block. With structured notes, investors can harness volatility to create yield or protection.”

Franck Fayard – Head of Financial Products, APAC

Designing for realistic expectations

The 60/40 model – predicated on the premise that investors can endure a degree of uncertainty as long as diversification is maintained over time – has served the investment community well for a long time. Today’s allocators and investors, however, operating in an increasingly technology-led and data-driven financial markets ecosystem, have increasing expectations that investment outcomes should and can be better defined.

Structured products are engineered to reflect desired investment views, directions and scenarios, but with pre-defined in-built conditions including buffers for early redemption and/or capital protection, and prescribed coupon levels and barriers. Despite some lingering market that this is just too complex – and costly – for many allocators and funds, in fact the transparency inherent in defined and engineered products supports more disciplined allocation and mitigates the behavioural pitfalls associated with chasing trends and trades.

“Don’t follow trends. Structure products to match your conviction, your risk appetite. That way, when markets turn, you will still know exactly where you stand.”

Franck Fayard – Head of Financial Products, APAC

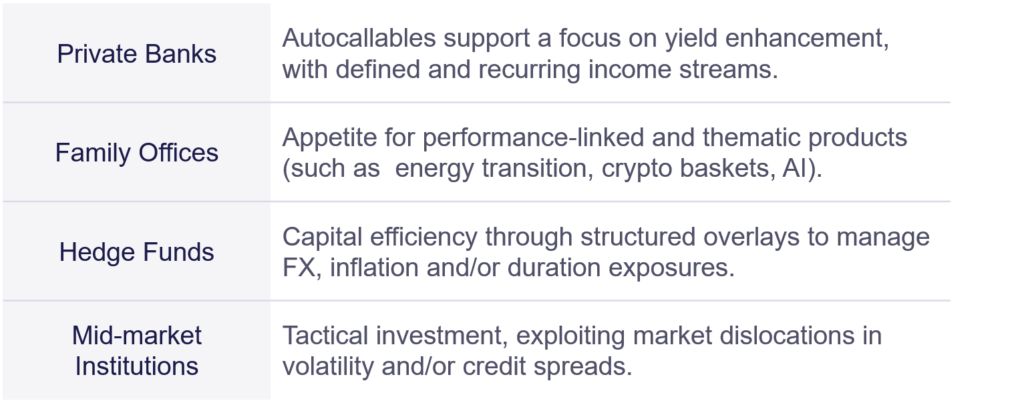

Solutions for every investor type and need

“Fixed income investors in GCC already understand coupons and maturities. With structured credit-linked notes, they can replicate bond exposure with greater flexibility and potentially high pick-ups.”

Mehdi Rayane, Financial Products Sales

The world has changed. Inflation, geopolitical tensions, declining globalisation and increasing global protectionism are eroding the traditional assumptions behind the 60/40 portfolio.

Not just another asset class, structured products are a way of designing exposure, with outcome-driven clarity. Whether engineered to deliver yield with conditions, risk with buffers or market access with boundaries, structured products augment blunt diversification tactics, and are the means for embattled investors to thrive in today’s challenging investment environment.