Structured Products in Focus:

A structured investment future – What’s next?

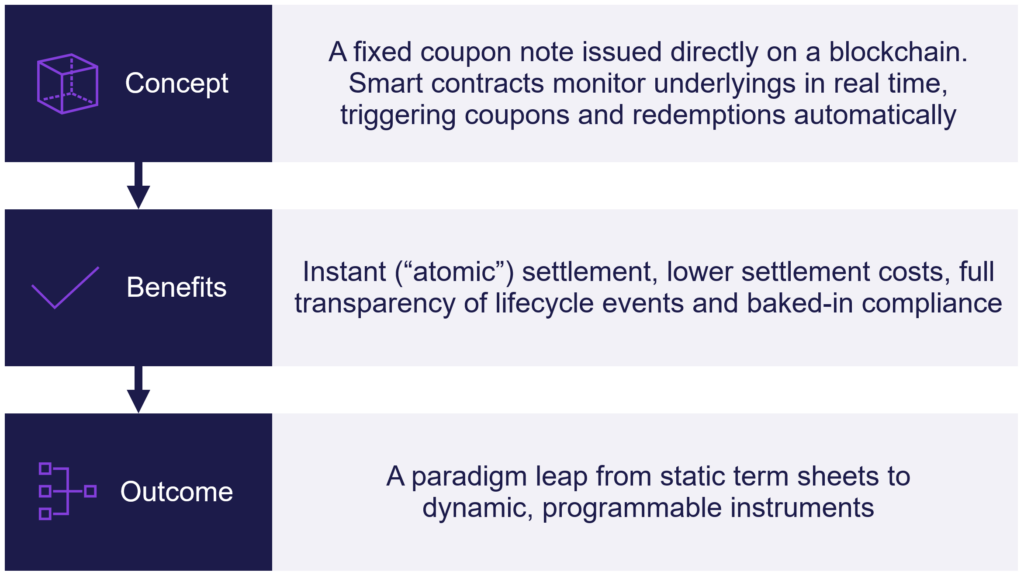

“Over the next five years or so, term sheets may well become smart contracts.”

Joost Burgerhout, Head of Marex Financial Products

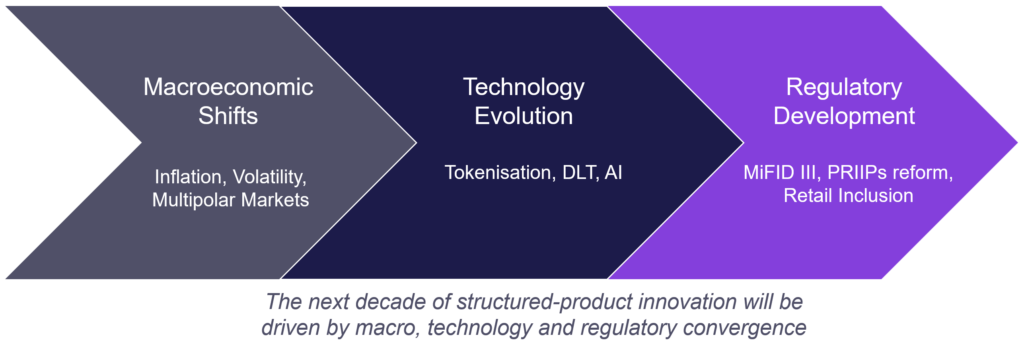

Structured products have evolved from niche bank-led investment opportunities into valuable mainstream portfolio allocation tools. But this journey is far from over. The next decade will see innovation driven by macroeconomic shifts, continuing regulatory evolution and accelerated adoption of new digital technologies like DLT (distributed ledger technology) and securities tokenisation.

In the final chapters of our series exploring the changing world of structured products, we look at where the market is heading and how structured products will continue to redefine the global investment ecosystem.

Macro drivers: Inflation, dispersion and multipolar expansion

Global markets have entered a new phase where inflation remains sticky, economic growth is unpredictable and fragile and geopolitical tensions and risks are multiplying. In this climate, yield curves invert then re-steepen, currencies swing sharply and commodities are subject to event-driven supply shocks.

“Volatility is not just noise – it’s the raw material of structured products. In the next global market cycle, that can only become more important.”

Franck Fayard, Head of Financial Products APAC

For all investors, volatility creates risk and opportunity and structured products that embed volatility and interest rate dynamics directly within payoffs, are well positioned to thrive.

Institutional allocators – from insurers and pensions to sovereign wealth funds – are increasingly embedding structured products into their strategic allocation frameworks. For them, it is less about occasional tactical trades and more about integrating defined-outcome instruments into liability-driven investing, ALM strategies* and ESG mandates.

*Asset–Liability Management: These are investment and risk-management approaches that aim to match an organisation’s assets (what it owns) with its liabilities (what it owes) in terms of timing, cash flows, and risk sensitivity.

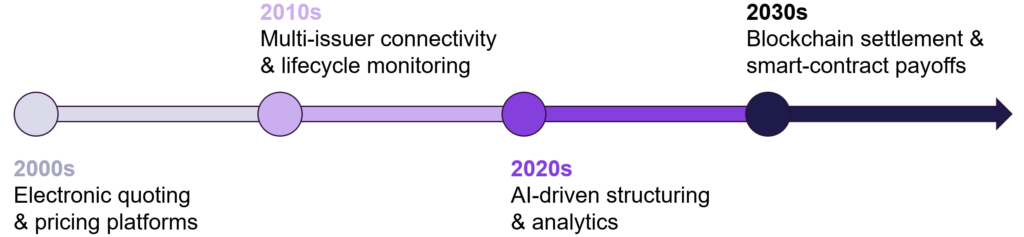

Technology: Tokenisation, DLT and AI

“Digital issuance is not the future; it’s the next iteration of efficiency.”

Joost Burgerhout, Head of Marex Financial Products

There is no doubt that technology has – and will continue to – reshape how structured products are designed, issued, traded and managed. Increased and accelerated adoption of distributed ledger technologies and blockchains to settle products could, ultimately, disintermediate legacy market infrastructure. Payoffs coded directly onto blockchain in the form of smart contracts could automate coupon payments, barrier checks and redemptions. AI structuring engines and algorithms could support faster and better payoff design, suitability checking and stress testing.

“Settlement systems are decades old. Blockchain can strip out layers of cost and friction. The current challenge is around standardisation and interoperability; once solved, it changes everything.”

Martin Kummer, Investment Solutions

Institutional adoption of digital settlement is a critical driver of change; some large distributors are already exploring tokenised note issuance as a way to reduce operational complexity and capital charges, while still meeting strict regulatory and reporting standards.

The radical and transformative shift from one conceptual framework to another may have been a bit of a slow burn up to now, but there is no doubt that momentum is growing with financial market participants, from banks and institutions to retail investors, much more actively embracing the opportunities presented by altering legacy conventions and perceptions around investment and trading rules and parameters.

Regulation: MiFID III, PRIIPs Reform and retail innovation

For professional investors, regulation may present operational challenges but it also boosts trust. Whether operating within traditional or new ‘deFi’ frameworks, regulation will continue to be a key driver underpinning investment strategy and activity.

“Transparency used to be a myth. Now, with tools and regulation, clients can see exactly what they own, and exactly what’s happening to it – and that builds confidence.”

Mehdi Rayane, Financial Products Sales

MiFID III and PRIIPs reform in Europe, for example, and new regulatory frameworks in Asian and MENA regions, may lead to further disclosure rationalisation and standardisation, reinforcing market transparency and fairness. Regulators may also open the door to broader retail access, with safeguards built into product design and distribution. For example, the UK’s FCA has – from 8 October 2025 – opened up the crypto ETN (cETN) market to retail investors, with appropriate guardrails.

For institutions, regulatory evolution is both a compliance burden and competitive advantage. Clearer disclosure standards allow insurers and pensions to treat structured notes as core allocation tools, while retail-focused reforms may broaden the investor base and deepen liquidity for institutional participants.

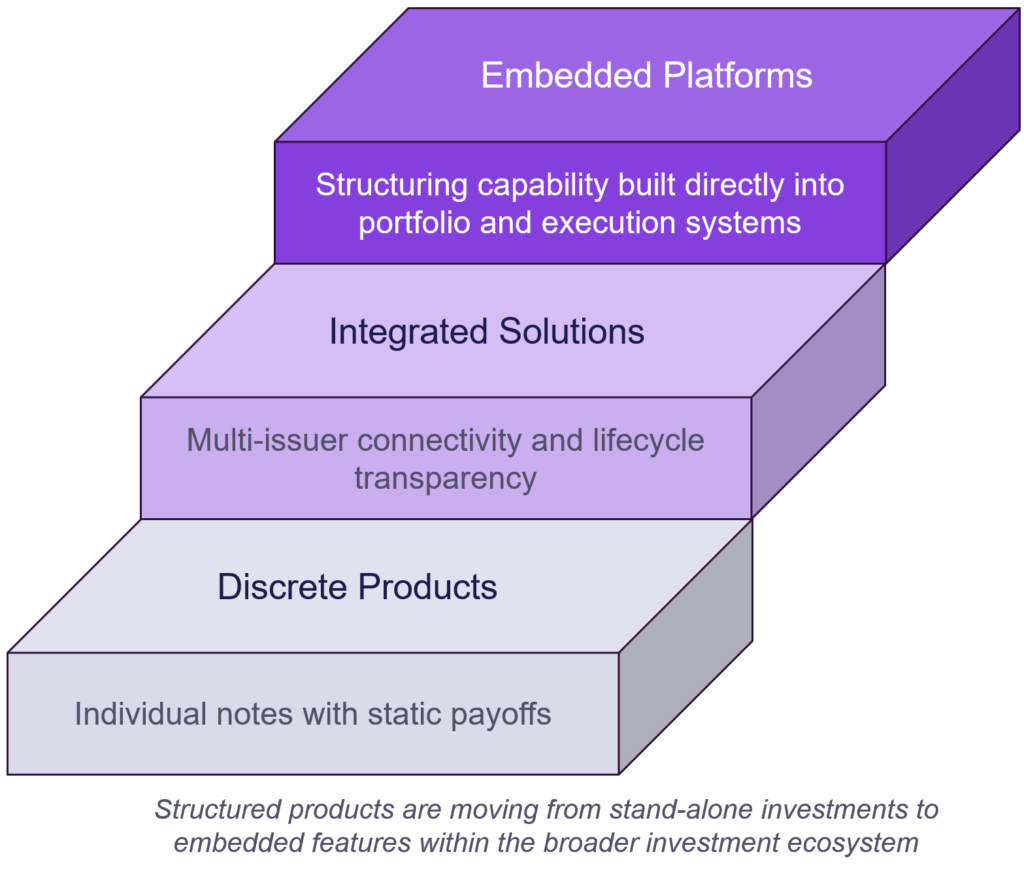

Distribution trends: Access embedded within wealth platforms

Structured products are increasingly being embedded directly into wealth platforms and advisory tools. Advisors can price, visualise and allocate structured notes alongside mutual funds and ETFs. This “structuring-as-a-service” model expands access and reach, particularly for tier 2/3 institutions, IFAs and wealth managers. The same model is also being embraced by institutional distributors. Sovereign funds, insurance companies and large asset managers are increasingly demanding multi-issuer connectivity and lifecycle monitoring within existing platforms, integrating structuring functionality directly within portfolio management systems.

“In Hong Kong and Singapore, structured notes trade almost like equities. Aggregation platforms show multi-issuer quotes in real time. That model will spread globally.”

Franck Fayard, Head of Financial Products APAC

From products to platforms

Another enormous conceptual shift is the transformation of structured products from discrete, limited opportunity instruments to an integral part of execution and risk management platforms. The investor mindset will shift from viewing structuring as a product purchase to an essential component of the service model and a highly efficient mechanism to engineer specific outcomes across portfolios.

“Structured products will evolve from instruments to infrastructure – a framework through which investors define risk and return in real time.”

Karim Meddah, Head of FP Sales Banks & Swiss Office

Designed outcomes in a redefined market

Structured products of the future will be even faster, smarter and more transparent. Tokenisation will reshape settlement, AI will transform design and distribution, and regulation will ensure fairness and clarity.

Regardless of financial market evolution into a digital-first era, structured products will continue to have one consistent and compelling advantage over traditional portfolio allocations, namely defined and designed outcomes in uncertain times and markets.

As such, structured products are not just adapting to the future. They are helping to define it.