Structured Products In Focus:

Evolution of structured products: Bank-to-investor-led design

“It’s not about selling products, it’s about solving for mandates.”

Nestor Macias, Head of Financial Products, LATAM

First appearing in the late 1980s and early 1990s, structured products began life as entirely bank-manufactured tools. Opaque and inflexible, they were primarily created as funding tools to support a bank’s balance sheet rather than to meet any burning market challenges or investor needs.

Early versions were developed by European banks in particular as ways to repackage bonds with embedded options, offering investors the opportunity for higher yields, or capital protection. They gained traction in the US in the early 1990s with the growth of retail-targeted notes linked to equity indices. By the mid-1990s, autocallables and equity-linked notes were being issued widely in Europe and Asia, and structured products were recognised as an asset class in their own right.

Since that time, the structured product model has shifted dramatically from bank-driven off-the-shelf products to sophisticated, client-first design shaped by regulation, technology and continuing market demand for financial markets transparency.

Today’s structured products innovators design solutions for and around investors, not issuers.

In transparency we trust

In the early 2000s, structured notes were packaged typically by large financial institutions, and pushed to clients as standardised, off-the-shelf offerings. Distribution was often inward-looking with banks using structured notes as a funding tool and issuing products that satisfied their own balance sheet goals rather than investor outcomes. The focus was transactional. Innovation was limited. Trust was fragile.

“Private banks particularly are proactive in seeking fully customised structured mandates – often with co-branded elements. That type of collaboration is where true innovation starts.”

Romain Joubert, Head of Financial Products Sales, France

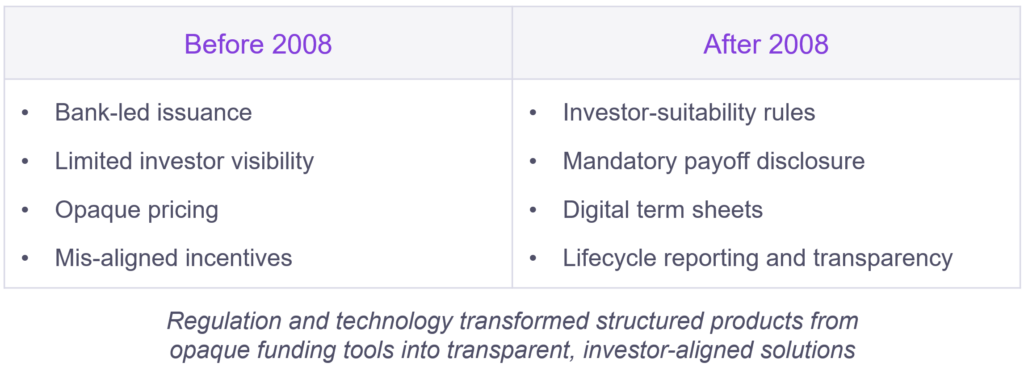

The 2008 global financial crisis was a turning point and catalyst for change. Products linked to failing institutions, such as the infamous Lehman “minibonds,” eroded market confidence. Regulators responded with sweeping legislation – like MiFID II in Europe – which laid down far more strict rules around investor suitability, disclosure requirements and lifecycle transparency. Opaque shelf-products gave way to greater customisation, clearer payoff descriptions and tighter risk management.

“Transparency is non-negotiable. Investors want to see the formula, the barriers, the triggers – and regulators demand it. Structured notes today are built to show, not hide.”

Franck Fayard, Head of Financial Products, APAC

Rise of client-led structuring

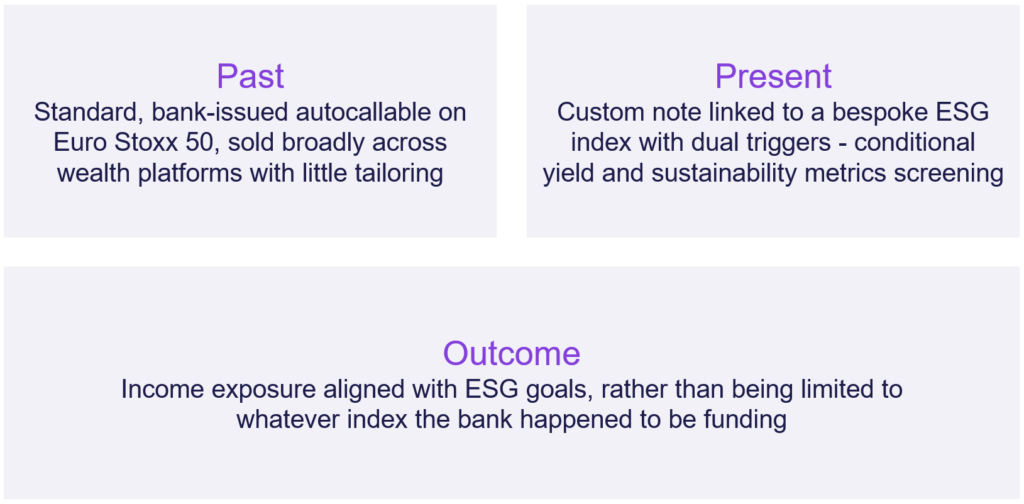

Post-crisis, the pendulum swung from issuer control to investor demand. Family offices, hedge funds and private banks began to request customised outcomes from structured products, for example income with barriers, thematic exposure or FX overlays. Today, client-first, client-led design is the norm: Investors define objectives relating to a particular market view, and product specialists engineer structured products with corresponding payoffs.

“The industry has moved from inventory-driven issuance to problem-solving. Investors don’t want off-the-shelf products; they want engineered outcomes.”

Karim Meddah, Head of FP Sales Banks & Swiss Office

From Opaque to Transparent: How Regulation Changed the Game

Off-the-Shelf Autocall to Tailored ESG Index

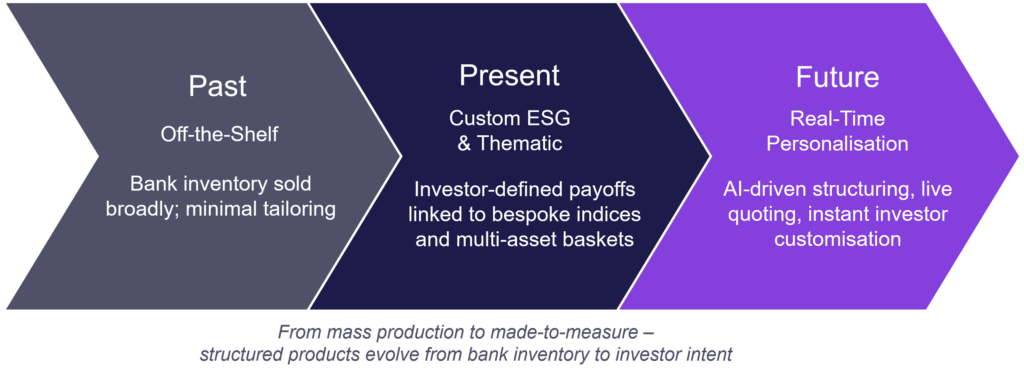

Mass production to made to measure

The most fundamental change in the world of structured products since their introduction in the 80s is product customisation. Investors increasingly expect – demand – innovative, tailored structures that reflect specific, sometimes esoteric (niche) and oftentimes complex desired outcomes. Investors may also be willing to pay a premium for precision – although this is not necessarily a given. Customisation doesn’t necessarily correlate with cost.

“It’s not about beating the market. It’s about having the market exposure we want, in the format we need.”

Martin Kummer, Investment Solutions

Of course, the ineffable march of financial technology has supported – and amplified – the shift from standardised to highly structured products. What once took weeks to design and build now takes next to no time: Digital platforms generate live quotes and customised scenarios in minutes, democratising access beyond top-tier institutions to private banks, tier 2/3 (regional) banks, wealth managers, IFAs and family offices.

“Structured products commoditise fast. Investors expect us to customise – and to do it in real time – with execution speed and flexibility.”

Franck Fayard, Head of Financial Products, APAC

Innovation, customisation and democratisation

Structured products have come a long way from their bank-led origins to today’s investor-first, innovative, tailored and transparent investment products.

“If you can say it, we can build it.”

Joost Burgerhout, Head of Marex Financial Products

Today’s investor community benefits from a sophisticated, structured products ecosystem that combines financial markets expertise, product engineering innovation, technology-led speed of execution and access flexibility (distribution). Above all else, today’s structured products innovators understand that control must sit with the investor, not the issuer.

Structured products are no longer a cynical and expensive (in terms of fees and performance) way for banks to raise capital, but are all about engineering tailored outcomes for allocators.