“Speed and visibility are now table stakes.”

Martin Kummer, Investment Solutions

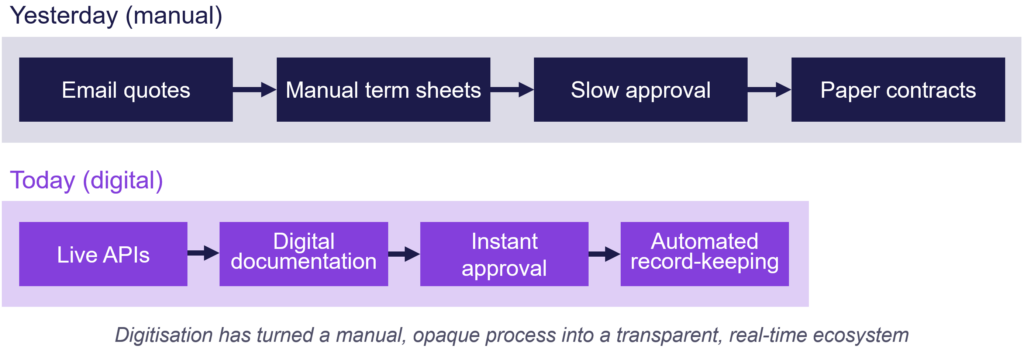

Evolving and advancing financial technology has transformed the way structured products are created, distributed and managed. What was once a lumbering, cumbersome and opaque process typified by lengthy email chains, delayed quotes and paper-heavy documentation has been reshaped into a near real-time digital ecosystem and experience.

Technology is the great enabler of access and scale and digitisation is transforming the end to end structured products value chain, from pricing to post-trade lifecycle management.

Structuring at speed and scale

Back in the day, when they first appeared on the investment management scene, a structured note might have taken days – if not weeks – to be created. Even a standardised, off the shelf bank product might have been subject to endless back and forth negotiation over terms and pricing, with associated and lengthy documentation necessary to seal the deal.

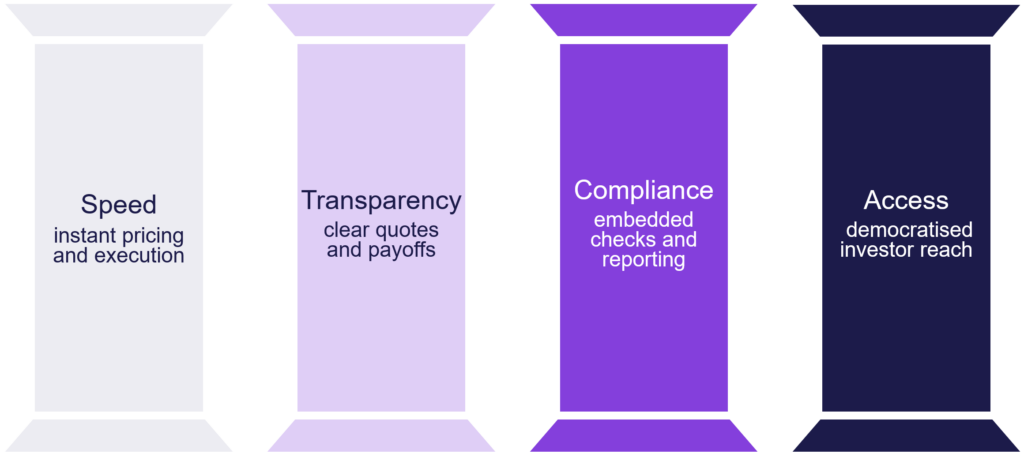

Today, live APIs and digital pricing tools enable instant product and price discovery. Investors can see scenarios across multiple issuers simultaneously, compare structures and select the structure – if not a specific product – that best suits their investment view, and mandate.

Accelerated ‘commoditisation’ is not just a matter of convenience – it fundamentally changes who can access and use structured products. Smaller banks, IFAs and family offices, for example, once excluded by cost and scale barriers, can today access institutional-grade structuring at the click of a button.

“Commoditised products are now traded almost like equities. Quotes are aggregated electronically, execution is automated, and clients expect speed as a given.”

Franck Fayard, Head of Financial Products, APAC

Real time price discovery and execution

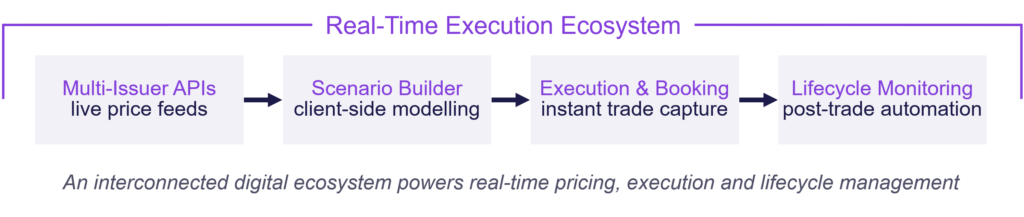

“Connectivity matters more than code. The real innovation is linking pricing, documentation and settlement into one continuous flow.”

Joost Burgerhout, Head of Marex Financial Products

Digital platforms enable investment advisors to run multiple scenarios – different strike levels, maturities, coupons and underlyings -simultaneously and instantly: They can stress test payoffs, compare volatility assumptions, and show completely transparent pricing to end clients.

“We invested heavily in automation tools. A client can see multiple pricings, ask for a presentation, and get it approved internally within hours. That’s a huge change from when structuring was manual and slow.”

Mehdi Rayane, Financial Products Sales

Real-time access and execution also enhances fairness. Price competition is visible, spreads are compressed and investors have increased confidence that they are not overpaying.

Beyond execution, a lifecycle revolution

Technology’s impact goes beyond execution. Digital platforms can monitor barriers, coupon triggers, redemptions and maturity outcomes in real time, supporting end to end automation of post-trade lifecycle management workflows – traditionally a manual, error-prone process .

“Restructuring underperforming notes used to be a reactive process. Now, lifecycle tools show investors when barriers are at risk, allowing for immediate investor action to extend or adjust the structure.”

Franck Fayard, Head of Financial Products, APAC

Technology innovation and digital automation, the elimination of siloes in front to back office functions and unprecedented levels of visibility mitigate potential surprises, enable proactive portfolio adjustment and improve overall liquidity management within and across portfolios.

Everyone’s an expert

At their heart, structured products are sophisticated derivative strategies, historically the domain of only the most sophisticated market participants. Technology advances make them easier to analyse and compare, opening access to a broader range of professional investors by demystifying perceived complexity with interactive payoff diagrams, scenario visualisations and intuitive dashboards.

“Clients sometimes assume structured products take weeks to build. When they see us deliver a live solution in an hour – complete with payoff visuals – it completely changes perceptions.”

Martin Kummer, Investment Solutions

By translating what might once have been perceived as high risk, highly speculative investment products into user-friendly outputs, technology is facilitating opportunity and access to a much broader investor base.

At the same time, regulation demands much more rigorous fee transparency and robust documentation. Digital workflows automate much of this burden, embedding compliance within the structuring process itself. This is critical for scaling structured products into broader wealth channels, where regulators more closely scrutinise retail-adjacent distribution.

Technology also supports investor education. Opportunities can be demonstrated and tested in real world scenarios, across client functions and teams, instilling trust and confidence in structured solutions as part of the investor toolkit.

“Private banking clients are increasingly seeking trainings and tools. Automation not only accelerates processes, but also ensures that key compliance requirements are embedded from the outset.”

Mehdi Rayane, Financial Products Sales

Technology – the great enabler

“Automation doesn’t remove the human element, it amplifies it. With real-time tools we can spend less time booking and more time advising.”

Karim Meddah, Head of FP Sales Banks & Swiss Office

Alongside market regulation, technology innovation has been instrumental in redefining structured product creation and delivery. From instant pricing to lifecycle monitoring, compliance automation to investor education, digital tools make structured product solutions faster, clearer and much more accessible.

“Financial culture in APAC is exceptionally strong, and structured solutions are widely understood and used.”

Franck Fayard, Head of Financial Products, APAC

Today’s platforms provide transparency and agility, transforming what was traditionally a bank-dominated, slow moving and niche industry into an active, vibrant market where structured product outcomes are visible, scalable and fast to market.