What is OTC Trading?

Over-the-Counter (OTC) derivatives are privately negotiated financial instruments that allow counterparties to customise trades based on their specific hedging needs. Unlike Exchange-Traded Derivatives (ETD), OTC trades are conducted bilaterally, offering greater flexibility in structuring contracts.

Marex provides OTC solutions across multiple markets, including commodities, foreign exchange, and interest rates. These instruments are mostly cash settled, meaning the counterparty pays or receives an amount of cash upon the expiry of the transaction.

Key Characteristics of OTC Trading

| Bilateral Trading | Clients trade directly with Marex Financial, a UK-based, FCA-regulated, investment-grade (BBB rated) financial institution. |

| No Initial Margin Requirements | Unlike exchange-traded products, trading on an OTC basis means the initial margin is typically fully funded, improving working capital efficiency. |

| Customisable Solutions | OTC contracts can be tailored to match specific risk profiles, including size, maturity, and payoff structures. |

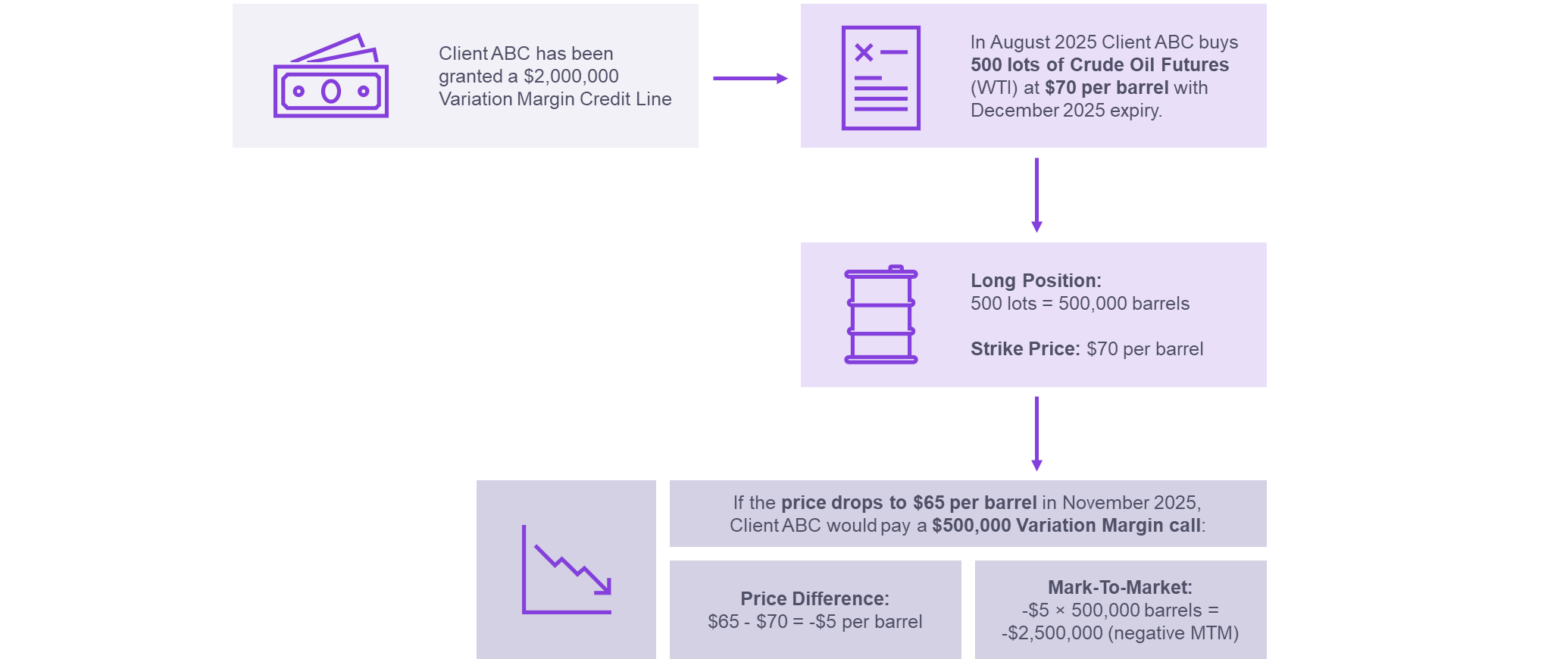

| Flexible Margining | Variation Margin (VM) can be funded up to a certain threshold, subject to credit approval. |

| Product Variety | Clients can access a broad range of instruments, including futures and options look-alikes, hedging of bespoke / un-listed indices, hybrids combining asset and FX hedges, and multi-asset strategies. |

Why Choose Marex for OTC Trading?

Working Capital Optimisation – Marex Hedging Solutions can offer tailored credit lines to clients following a comprehensive credit assessment. This can help to minimise the burden and frequency of paying margin calls, optimising your trading experience. We assess each client’s creditworthiness individually to determine appropriate credit facilities which align with our risk appetite. A margin call should only arise when the negative mark-to-market of a client’s portfolio of trades exceeds the Variation Margin threshold granted after their credit assessment.